We work closely with Hollard, a long-standing Flow client, on digital communications strategy and execution. We produce a wide range of integrated digital communications, including blogs, social media, newsletters, graphics and animations, events coverage and videos, mainly for Hollard Insure, the company’s short-term insurance division.

Case study: digital newsletter

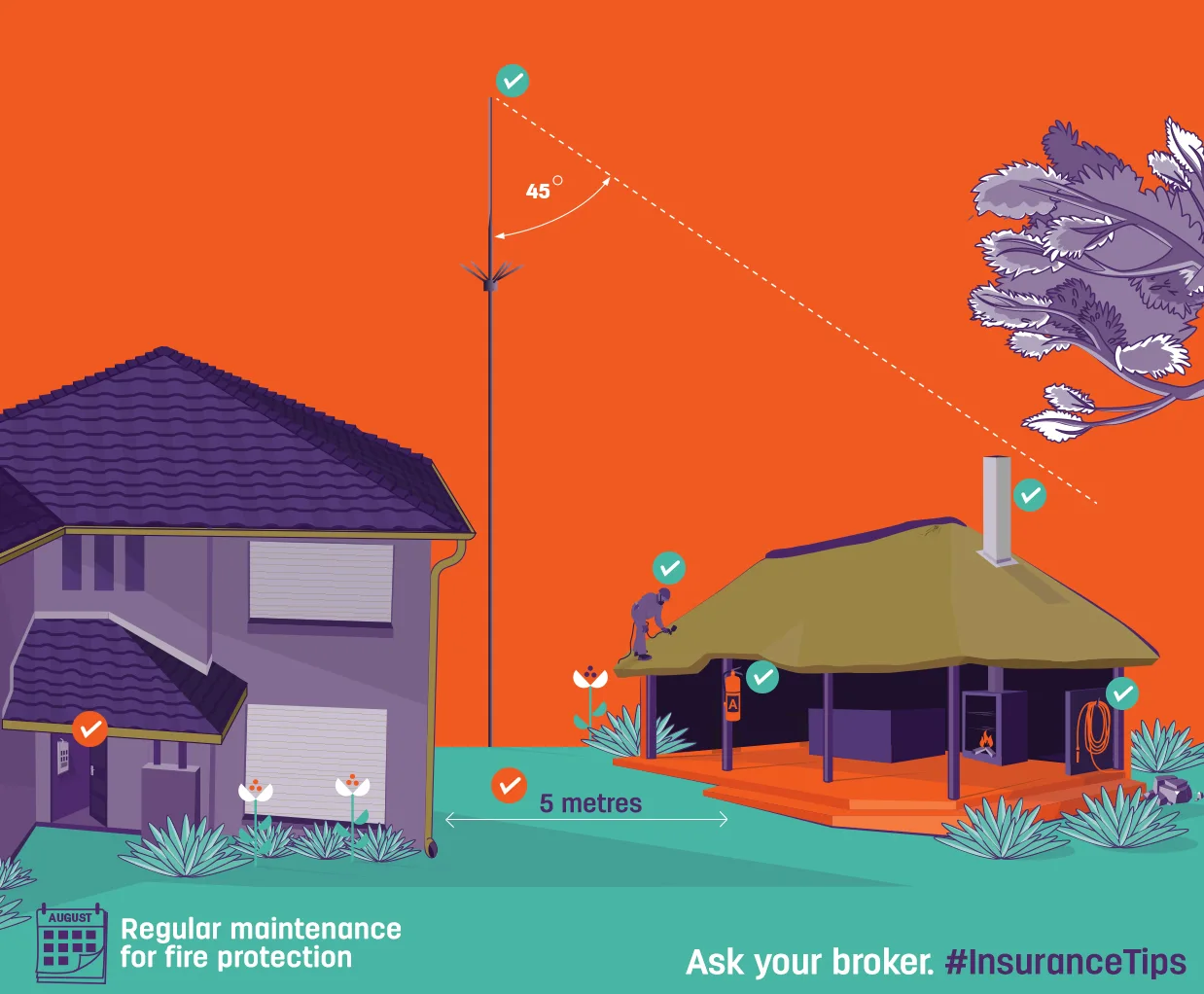

#InsuranceTips is an ongoing, regular, open-ended informational series of digital content produced for Hollard Insure, the short-term insurance division of the Hollard Insurance Company Ltd.

Strategy

Each instalment of the series addresses a specific insurance-related matter – among others, issues such as roof maintenance, lightning and fire protection, drones, home automation, art and collectibles, etc. – in a striking and easy-to-follow way.

The ultimate point of the series is to assist insurance brokers to explain complex insurance concepts and requirements to their clients, so that those clients can grasp the insurance cover that they are buying and be sure that they have proper, correct cover. By ensuring that consumers are well informed and have the right insurance, a win-win-win scenario is created: the consumer, the broker and the insurer all benefit.

The various insurance matters that make up the series are created using the following strategy:

- A tactical article

- Bite-sized infographic posts on social media that tease/pique brokers’ and consumers’ thought processes

- Supporting social media posts that further support the article, and unpack the topic more for the consumer

- Leverage other digital platforms to amplify the message through an unravelling “storytelling” method, in order to create longevity

Efficiency

Each #InsuranceTips instalment is prepared weeks in advance – two instalments ahead – to afford Hollard’s marketing team and in-house insurance experts to comment on content, and to give Flow’s writer and designer the time to create and tweak that content accordingly.

This results in high-quality content that impresses users, and promotes the series’ continuity.

Content

Central to propagating awareness of each #InsuranceTips instalment is an e-newsletter that is sent to a database of insurance brokers, many of whom then forward the emailer on to their colleagues and clientele.

At the heart of each instalment of #InsuranceTips is a succinct, clearly written blog, which is posted on the Hollard corporate website under the #InsuranceTips tab in the intermediaries’ area (www.hollard.co.za/brokers/tips). The blog explains the concept, with an accompanying graphic as the main illustration.

The main graphic is also used on the Hollard corporate Facebook page, as well as the Hollard Insure LinkedIn page, to drive users to the blog.

The main graphic is then broken up into a group of sub-graphics and/or GIFs, each illustrating a part of the instalment concept. These are then used on the Hollard Insure Twitter feed with bespoke written content to drive users to the blog.

Finally, the main graphic – along with teaser copy – is used in the e-newsletter, which is sent to insurance brokers, who can click through from the newsletter to the blog.

Creativity

#InsuranceTips employs a combination of written, graphic and animated content across a variety of communications platforms, including online (blogs), e-newsletters and social media – each supporting the other in order to maximise the potential for user awareness and engagement.

Innovation

All #InsuranceTips content is brand-agnostic (although Hollard’s corporate colours of purple, orange and teal are extensively used). Hollard took a decision in principle that #InsuranceTips content should be free for use by all interested brokers, not only those with whom it partners.

Brokers who access the content are free to use it as they wish.

Coverage/reach and results

Within the period 1 May 2017 to 31 May 2018, the e-newsletters were sent to a database of 2 173 brokers, who then forwarded the emailers on to their colleagues and clients, resulting in a total of 28 943 opens of all emailers.

The highest open rate from a single broker recipient was in the #InsuranceTips – Tip 2 emailer, with a total of 591 opens of that specific emailer. This shows clear amplification of the newsletters through forwarding them.

Despite a changeover from the old Hollard Broker Zone website – dedicated to its short-term insurance offerings – to the new Hollard corporate website (which went live in September 2017), all 12 #InsuranceTips blogs that fall within the period of 1 May 2017 to 31 May 2018 rank within the top 50 entries (out of the 325 listed) in the new website’s Google Analytics.

Within this period the top five blogs across both the old and new websites are:

- #InsuranceTips – Tip 1: Protecting your home, sweet home (total of 1 017 views)

- #InsuranceTips – Tip 7: Solving your geyser problems (total of 716 views)

- #InsuranceTips – Tip 6: Protecting yourself against lightning strikes (total of 590 views)

- #InsuranceTips – Tip 9: Protecting your greatest asset: your child (total of 548 views)

- #InsuranceTips – Tip 8: What to do if you had an accident (total of 436 views)

The 12 #InsuranceTips blogs have been viewed a total of 5 835 times across both the old and new websites during the period 1 May 2017 to 31 May 2018.